Russia's Economic Future - Semiconductors, Arms, And More

They claim Russia is reliant on the West but... is it actually the reverse? The eye-opening truth revealed.

A lot of ink has been spilled recently regarding Russia’s economic future vis a vis the ‘crippling sanctions’ enacted by the odious Western Atlanticist powers. The pro-Ukrainian / Western-Imperialist sphere is bubbling with hubbub about the purported destruction of Russia’s manufacturing and economic potential, particularly in select, critical industries like semi-conductor and weapons manufacturing, without which it is claimed Russia’s military campaign would be in jeopardy.

But let’s take a look at a few recent revelations which paint quite a contrary picture to what we’ve been told.

Firstly, a brief contextualizing primer to refresh our memory with what transpired in the past year since the start of the SMO. We know already that the Ruble has long been declared the strongest currency of 2022, due to its spectacular rise not only from the brief shock it suffered at the start, but in the way it surpassed even pre-SMO levels.

We know, too, that Russia was raking in an absolutely gobsmacking and unprecedented $20 billion PER MONTH in oil sales, leading to huge growth of foreign exchange reserves.

The West, in fact, gloated as they ‘seized’ half of these very foreign exchange reserves, over $300 billion in number. Many in the resistance sphere lashed out at the lack of foresight in the Kremlin and Russia’s much-maligned central bank. However, a little known fact that’s not oft-discussed is how Russia actually in-turn seized an equivalent $300b of Western assets as well. Most of these were not Forex but rather enterprise assets from the various Western megacorps operating in Russia.

For instance, few took note of this much-overlooked comment from Dmitry Medvedev:

And it’s true: if you recall, Russia seized many Boeing jets that were leased to its airline companies.

So far they’ve only recovered only 24 out of the 500 jets Russia was withholding, and the remainder were worth in the $10+ billion range alone. (and the numbers are iffy, at that, considering 470+ jets worth in excess of $80m each should be a grand total of ~$40 billion, not the “$10b” they claim, lest those jets only cost $22m a piece, which is doubtful—but we’ll indulge them)

An industry insider told Bloomberg that foreign leasing firms have repossessed only about 24 of the more than 500 aircraft rented to Russian carriers. The remaining planes are reportedly worth about $10.3 billion USD ($14.1 billion AUD).

Initially, there was concern that Russia would not have the parts to service those jets and thus would be checkmated by the West, but in fact it was later confirmed that Russia managed to acquire a parts pipeline via India/China. And that’s just one of the many enterprises Russia took over. The list is long of major Western oil companies, for instance, worth tens of billions which fled and left their lucrative operations fully in Russian hands. And these are just a few of the things Medvedev is referring to when he said that Russia too has seized $300b worth of equivalent assets.

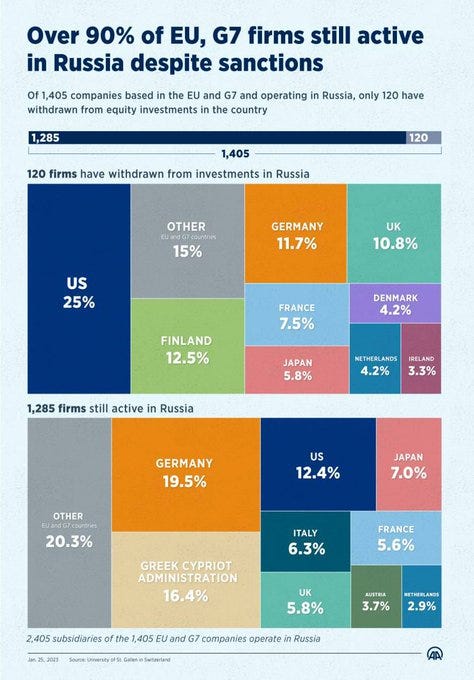

But this area too has been a Western dud in other ways. We’ve now seen that only a tiny fraction of the companies which threatened to leave and thereby ‘crush’ Russia’s economy did in fact put their money where their mouth is. Only 120 out of 1,405 companies ended up leaving, and the majority of that negligible number were from the U.S. anyway.

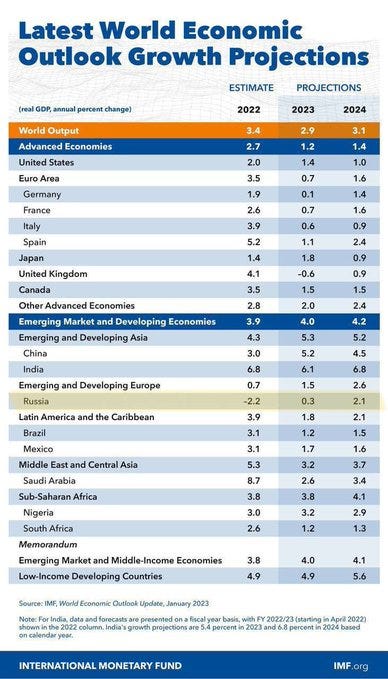

In fact, in a highly ironic announcement, it’s now been reported that Russia’s economy is not only set to grow rather than contract in the ensuing years, as per the IMF, but its growth rate is set to overtake that of the U.S. and UK.

And this is all from Western economic sources. Doh!

As can be seen on this chart, the IMF now forecasts Russian economy to grow in 2023 rather than contract (which was the previous forecast), and in 2024, it expects GDP growth of 2.1%. That might seem small, until you look at their forecast for the leading Western nations: 1.0% for U.S., 1.6% for the entire Euro area with Germany at 1.4%, France at 1.6%, Italy and UK at 0.9%, respectively, etc. That’s quite contrary to the typical low-effort propaganda flung around by Russophobes in the twitter-sphere and elsewhere.

Now for the nitty-gritty. A lot of talk revolves around the critical topic of Russian semi-conductor capabilities, a major classical weakness of the Russian economy and capability in general. There’s some optimistic news here too.

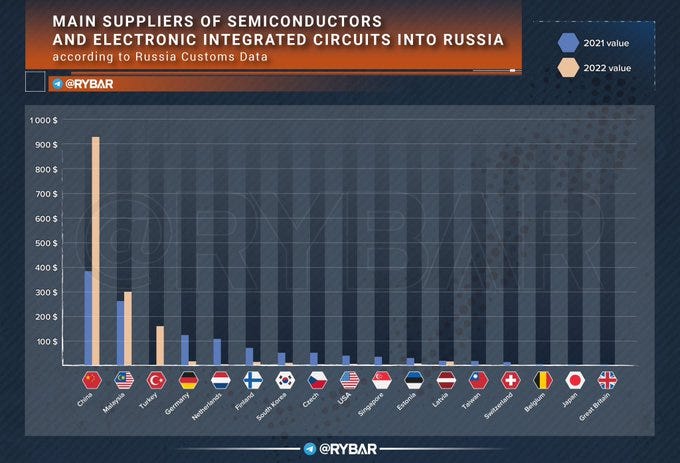

This chart shows that Russia’s supplies of semi-conductors and integrated circuits from key Western countries has expectedly dwindled in 2022 as compared to 2021. However, promisingly, the supplies from key Eastern economies have skyrocketed exponentially. If we assume the figures on the left represent ‘millions’, then China has increased its supply of micro circuitry to Russia from $400 million in 2021 to nearly $950m. Malaysia has increased by $20-30m and even Turkey came to the rescue, boosting their support from $0 to a whopping $150m.

The key thing here is: the net loss of supplies from the West appears to be somewhere around $500m. Yet the net gain in product substitution from the East is well over $700m. So not only did Russia completely nullify the semi-conductor losses from the sanctions and completed successful import substitution, but they even gained a sizable increase—which likely corresponds to the vastly accelerated demand for semi-conductors/circuitry in light of the manufacturing uptick in Russia’s defense industry for the SMO.

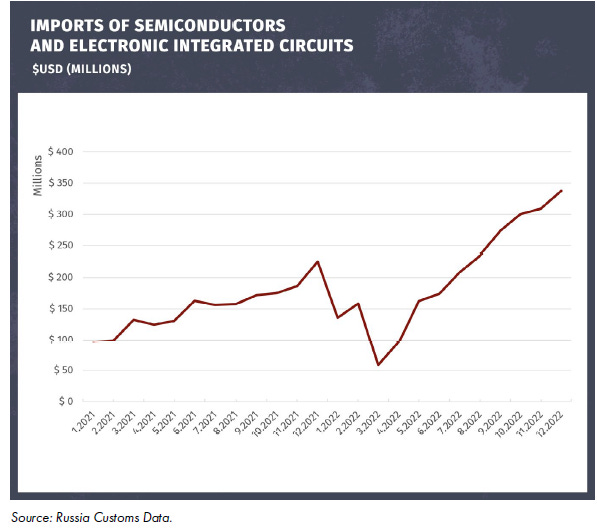

But don’t take my word for it, here’s a thread from an actual chief economist and Russian sanctions expert at various globalist think-tank/institutes. She obtains roughly the same numbers, and here’s her chart:

As you can see, Russia’s importation of circuits has nearly doubled in 2022. That means the sanctions are not only a complete bust and have not resulted in even hindering Russian capabilities whatsoever, but in fact have done Russia a massive favor by giving it the impetus and incentive to completely reorient its supply chain of critical infrastructure technologies to the much more reliable partners of the East. And what’s more, China itself has now announced massive new investments into chip-making plants and general semi-conductor capabilities as a response to U.S.’s recent sanctions and general aggressions against Chinese chip/technology.

That means China will soon be an even bigger powerhouse in this sector, able to supply Russia with everything it needs for the future. Of course Russia itself is still trying to kickstart its own semi-conductor industry as well and there’s been some headway, though nothing impressive to write home about yet. But they have signed new initiatives, such as the following:

The Russian government has devised a preliminary plan to tackle the issue. It involves investing around 3.19 trillion rubles ($38.3 billion) in developing the local microelectronics industry. This money will go to four main areas: development of local semiconductor fabrication technologies, domestic chip development, marketing of the said chips, and training the local talent.

As of now, Russia is roughly 15+ years behind the leading Western capabilities in semi-conductor design. This means that the transistor size Russia’s leading Mikron group is currently capable of manufacturing on their chips (65nm) is roughly equivalent to what Intel was doing in 2006. Current Intel chips are at the 5nm and 3nm scale. With that said, this is not as big of a problem as it may appear, at least not for military applications. Sure, for consumer mass-scale produced electronics it’s a huge difference. But the vast majority of today’s current weaponry still uses decades old circuitry. After all, U.S. still has many Tomahawk and other missiles in stock that were produced many years ago, with circuits that could be dated from the 90’s or 2000’s, most tanks and their electronic fire-control systems were produced in the 80’s and 90’s, with associated technology, etc. For those basic navigational, tracking purposes the circuitry of that era can still be more than “good enough”. You don’t need super advanced 5nm chips to do basic terrain-mapping and GPS-tracking etc. However, when it comes to artificial intelligence capabilities, which is becoming progressively more important, then you do need raw computational power, and the one with the power will have the far “smarter” and more capable systems in that regard.

And things are not as peachy as they seem for U.S. and the West on that front. For instance, there’s the ignored reality that it’s in fact the West and their military-industrial potential that’s dangerously reliant on Russia/China, rather than the much-more-often discussed reverse.

This article outlines how Western arms manufacturers are not only highly reliant on Russian raw materials, without which they cannot produce gunpowder and many other weapons systems, but on Russian-Ukrainian rail networks which transport the even-more essential Chinese minerals across to Europe:

Quite an inconvenience for those who bloviated about the many small parts and Western circuits found in Russian weaponry seized in Ukraine, yet selectively ignored the impossibility of manufacturing those very parts without Russian raw materials.

China supplies more than 90% of rare earth elements used in Europe, and the latest EU data show Russia railway lines remain a busy shipping lane and a key leg of Beijing’s “Belt and Road” initiative.

And this article highlights how Ukraine has one of the largest titanium deposits in the world, a metal absolutely essential for all the most advanced weapons systems of the world.

If Ukraine wins, the U.S. and its allies will be in pole position to cultivate a new conduit of titanium. But if Russia manages to seize the country's deposits and plants, Moscow will boost its global influence over increasingly strategic resource.

And guess what? Not only are China and Russia among the top 3 producers of titanium:

But most of the massive titanium deposits (and other rare earth metals) in Ukraine which the West so breathlessly salivates over are in the Donbass and ‘Novorossiya’ regions:

Which correspond pretty well with the territory Russia will likely annex:

Newsweek: “A Vital Commodity”

The Interior Department has classified titanium as one of the 35 mineral commodities vital to U.S. economic and national security. But the U.S. still imports more than 90 percent of its iron ore, and not all from friendly nations.

So, as you can see, the West, as per usual, projects its own inadequacies: it’s not Russia in dire need and foundering under the weight of the West’s sanctions, but the resource-less West terrified of losing their grasp on resources vital for their survival in the face of the nascent birth of a new multi-polar world led by Russia and China.

The U.S. no longer holds titanium sponge in its National Defense Stockpile, and the last domestic producer of titanium sponge closed down in 2020.

Ukraine is one of only seven nations producing titanium sponge, the basis for titanium metal. China and Russia—America's most prominent strategic rivals—are among this select group.

“Moscow's weaponization of energy resources has prompted fears in Washington, D.C. and other NATO capitals that the Kremlin may one day also freeze titanium exports, which would put aerospace and defense companies in a bind.

Aerospace giant Boeing maintains its joint venture with Russia's VSMPO-Avisma—the world's largest titanium exporter—though froze orders following the invasion. Others, like Europe's Airbus commercial aircraft corporation, continue to source titanium from VSMPO.”

I recommend reading the rest of that Newsweek article. It is eye-opening in regard to U.S.’s utter desperation to secretly wrest control of critical Ukrainian rare earth metals from Russia, and how American arms and aerospace industries would be devastated if Russia were to rob them of those key metals. The U.S. oversells Russia’s putative ‘reliance’ on the West for key industries in order to disingenuously hide their own desperate reliance on Russian metals, oil, gas, energy, timber, and everything in between.

There’s more I’d like to get into regarding the specifics of arms manufacturing—what are Russia’s true stockpiles and capabilities for manufacturing shells, munitions, and guided missiles? But we can leave that discussion for Part 2. But, as always, be sure to subscribe so you can get the notification sent to you for the succeeding parts.

Feel free to leave your comments, questions, and criticisms/suggestions below. And stay tuned to Part 2 of the Coming Offensive series—which will likely be next.

Hi,

nice write-up. There is one thing you missed though, and that's Russia's actual domestic chip capability. It's way beyond 65nm. They were already making 30nm in 2011 (prototype stage). Martyanov had a post about it a little while back:

https://smoothiex12.blogspot.com/2023/01/and-now-something-off-left-field.html

What's important to note is a huge difference between Russia and the west in WHO is doing the cutting edge research and production of these chips. In the west it is commercial enterprises who are responsible for it, and for their own commercial benefit, widely proclaim their accomplishments. In Russia though, it is being done by organisations who (directly or indirectly) report to the government and who keep their (high end) capabilities a secret. Understandable, as the primary beneficiary are defence related projects. So we don't actually know what Russia can produce on its own when it comes to chips, but given all those extremely high-tech military developments come out of Russia, I doubt they are lagging far behind, if at all.

Great article.

I have barely started reading and I already see information here that is new to me.

You are the first person I have bothered subscribing to on SubStack.

I am glad I took a look.

Many thanks.