Recently I’ve gotten a lot of requests to discuss Russia’s new digital Ruble, signed into law by Putin on July 24. It’s been oft-included in the blanket scary ‘CBDC’ category under the narrative that Putin is some sort of WEF stooge secretly helping to roll out the ‘Great Reset’ agenda.

As a quick digression to clear the plate—we all know by now that Putin’s previous designation by Klaus Schwab as a ‘Young Global Leader’ was in fact a lie:

The Young Global Leader program has an age limit of 38—thus the ‘young’ moniker. At the time of the program’s foundation in 1993, Putin—who was born in 1952—was already 41 years old.

Days ago, Republican presidential hopeful Vivek Ramaswamy was reported to have won a lawsuit against the WEF for erroneously labeling him a ‘Young Global Leader’:

He explains the outrage in his video:

And he even posted an apology letter sent from the WEF:

Tulsi Gabbard had previously suffered from the same issue. She was put on a ‘Young Global Leaders’ list without her permission or consultation.

Though to be fair, for his part Ramaswamy was a vaccine pusher, a fact he now tries to hide by allegedly paying to have that info edited out of his wikipedia page, and Gabbard was a member of the CFR.

Either way, the point is that Klaus Schwab, like many of his globalist ilk, routinely tarnish people by including them in their circles without permission. It’s something to note and keep an eye out for. And I preface with this because much of the information related to Russia and central banking, CBDCs, Great Reset, etc., takes on a similar cast—Russia is unscrupulously corralled in with a lot of globalist machinations of which it actually has no part.

Putin has met with Schwab in St. Petersburg in 2019, but I believe as a leader Putin’s job is to meet and act cordial—at least on the surface—with everyone. But that doesn’t mean he sponsors what they’re doing or is in cahoots with them. Putin meets with everyone, including Kissinger many times in the past. You know what they say about keeping friends close and enemies closer—it’s the best way to understand and monitor them. Not to mention, this was pre-pandemic; afterwards, a lot of things changed.

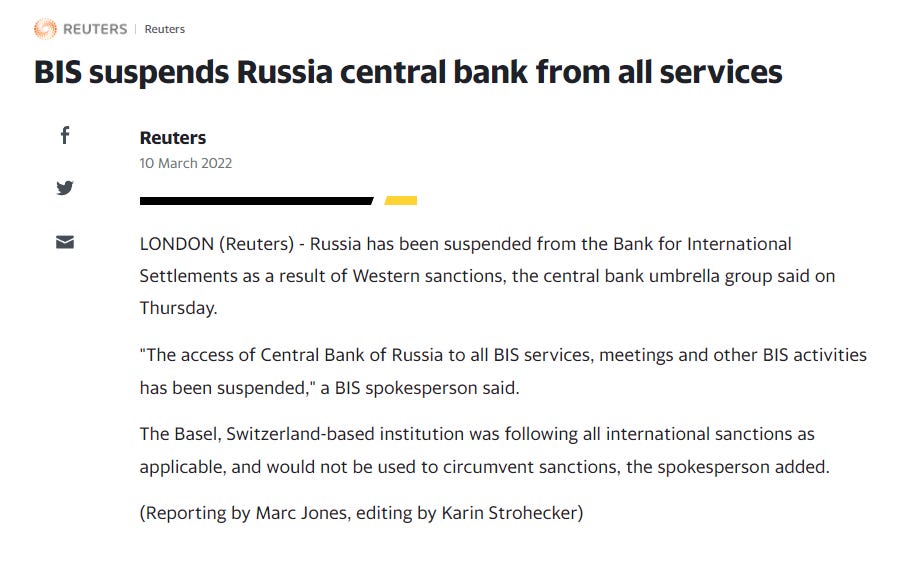

But let’s start with a comparison of Russia’s central banking system to that of the U.S. Federal Reserve. The systems are very different. One must first understand that Russia is now officially ‘disconnected’ from the Western banking order. Not only has it been cut from SWIFT, but it’s also been booted out of BIS, or Bank of International Settlements, which is the most powerful institution and central node of the entire Western global financial network.

The BIS is the central bank for all the globe’s central banks, holding a percentage of all their reserves. In fact, a new RT article even uses the disconnections as reason for Russia’s CBDC creation, as it helps them to further bypass the Western financial arm:

Many have previously accused the head of Russia’s central bank Elvira Nabiullina of being a globalist plant. The problem is, Russia’s central bank does not work like the not-so-Federal Reserve, and does not leave much room for the same type of syndicate co-option by private interests which is rampant in the Western system.

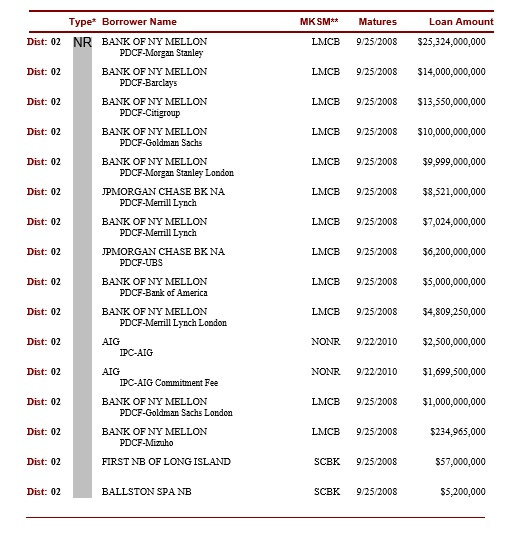

How the Federal Reserve of the United States works is that the main top-level Fed central bank in DC is comprised of a group of 12 regional member banks, like the NY Fed, Boston Fed, St. Louis Fed, etc. At this level, the system still appears ‘federal’ rather than private. But each of these member banks is actually comprised of, or rather owned by, the private member banks like JP Morgan, Citigroup, Bank of America, et al, who have purchased stock in them, and are tasked with appointing their Board of Directors. To clarify, the Board of Directors in each of the 12 regional Federal Reserve banks is elected by the private banking powerhouses like JP Morgan and co. In fact, here’s a list of the top shareholders of the NY Fed as a sample:

The largest shareowners of the New York Fed are the following five Wall Street banks: JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of New York Mellon. Those five banks represent two-thirds of the eight Global Systemically Important Banks (G-SIBs) in the United States. The other three G-SIBs are Bank of America, a shareowner in the Richmond Fed; Wells Fargo, a shareowner of the San Francisco Fed; and State Street, a shareowner in the Boston Fed.

So these private banking powerhouses in fact own the Federal Reserve bank and even appoint its directors, and make profit via dividends on the shares they hold in the Fed bank. This creates massive conflicts of interest. For instance, during the 2008 crash, the NY Fed naturally bailed out its largest shareholders despite huge amounts of fraud and malfeasance from those private mega-banks. NY Fed’s disbursements to the banks which own it:

Secondly, on an individual level, there are endless conflicts of interest for the actual board members of the Fed banks. The most high profile case was that of Jamie Dimon who was the CEO of JP Morgan Chase at the same time as serving on the Board of Directors of the NY Federal Reserve bank. But this is actually normal, as directors are chosen literally from the field of CEOs and other big wigs at major corporations. For instance, here’s the board of directors from the NY Fed’s own website:

Note how every member of the board for the NY Federal Reserve is a CEO of another major corporation (IBM, etc.) or major financial institution or bank. The president of each of the 12 Fed banks makes up the FOMC committee of the Fed central bank in DC, which is one of the chief organs of the Federal Reserve System which oversees market operations. That means this arm of the Federal Reserve is directly run by the CEOs of major corporations, banks, etc., acting as parallel ‘board of directors’ to the central Fed’s own ‘Board of Governors’ headed by the Fed Chairman.

Another example is how in 2008, Stephen Friedman was a chairman of the NY Fed and sat on the Board of Directors of Goldman Sachs. Not surprisingly, he was able to get Goldman Sachs a ‘bank holding company’ title (they were previously just a hedgefund and not allowed to operate as a bank) which allowed them to greedily siphon cheap Fed loans. There are many other examples, particularly older ones can be found in such places as Eustace Mullins’ works on the Federal Reserve system.

Russia’s central bank system doesn’t function in this way. In fact, the Russian central bank is not comprised of any member ‘branches’ and has no type of private or corporate ownership in the way of the U.S. Fed. It simply has offices of the main central headquarters in different parts of Russia, but these are just administrative offices and nothing more. Further, because of this much simplified structure, the bank is administered primarily by a far more transparent board of directors which are appointed by the Russian president and State Duma. And most importantly, those directors are not involved in the same conflicts of interest as are possible and rampant in the U.S.—i.e. sitting on boards of other major globalist conglomerates and private commercial banks.

In fact, in Russia the banking situation can almost be said to be backwards to that of the U.S. in the following way. In the U.S., the largest private banks control the government and its monetary policy by way of their direct control over the Federal Reserve itself. In Russia, the largest banks in the country, like Sberbank, VTB, etc., are actually majority-state owned. Which means the Russian government has the controlling share and say in them.

With that said, Sberbank is headed by one of the few people at the top of the Russian food chain that we can unequivocally say is a full-blooded globalist, or mostly so: one Herman Gref, the ethnically German and seeming WEF stooge. He has served on the WEF board of trustees before, though he’s apparently not on it in the post-Covid era, and has been behind attempts to usher in a lot of WEF-initiated-and-designed societal ‘changes’ into Russia.

Hence, Russia isn’t perfect, and has some bad seeds actively working in its financial industry—but like I said, that’s the half-private Sberbank, not the Bank of Russia, which is Russia’s central bank. My point is not to exonerate those, but to simply point out the other major differences which makes Russia very unlike the West.

In fact, what’s startling for people used to the cronyism of the West, is that if you click through each member of the Bank of Russia’s board of directors, you’ll note that all, save one, are career state bankers, economists, or some type of career state employees. Meaning they’ve worked in various positions in the Bank of Russia or other state institutions for the majority of their careers rather than in private hedgefunds, investment firms, corporations, and the like, as is so common in the U.S. Federal Reserve system.

There’s simply nothing of this sort in the Russian system. Interestingly enough, the one member that does have previous experience serving semi-private interests is Alexey Zabotkin, having worked for the investment arm of VTB bank, though it’s majority-state/public owned. And quel surprise—he also appears to have more of a globalist tint about him, as he’s jet-setted in WEF-linked events and talked up CBDCs from what appeared a Western perspective of ‘control’. Like I said, there are some bad seeds, but they are in the minority compared to the West.

Furthermore, some have documented how deeply the banking systems of various Western countries have been penetrated by the old families who are said to control the entire system at the top, i.e. Rothschild and co. Every continent is infiltrated by them, for instance South America has many Rothschild investments in coordination with Banco Bice and many other institutions. But Russia is one of the few countries that has no serious Rothschild presence, save for one small office merely functioning as a dusty outpost of sorts or, more probably, eavesdropping center.

How do we know this? For one, a Rothschild official annual report can be seen here. It lists all their global holdings and growing businesses in various countries. You’ll note that in every continent and country there are strong and growing operations, even new inroads being announced in China, though this report is now dated. But Russia—nil.

Secondly, Alexandre de Rothschild, head of the Rothschild France division—one of their most powerful arms—was recently pranked by the Russian [GRU agents] comedians Vovan and Lexus. In the call where they pretend to be Zelensky, Alexandre admits the Rothschild family has a ‘fantastic’ relationship with the Ukrainian government and has been working hand-in-glove with them since 2017. But the key moment comes at 1:45 when “Zelensky” asks Rothschild for help reaching some ‘Russian elites’ for negotiations, and wonders whether Rothschild has connections of this sort in Russia:

Rothschild very clearly states that they have no connections whatsoever in Russia, barring a tiny symbolic office, which itself was actually closed down at the start of the conflict.

“We’ve had very little involvement in Russia.”

Straight from the horse’s mouth.

Stunningly, he further confesses that “We have no Russian client in our private banking wealth management division.”

Need more be said?

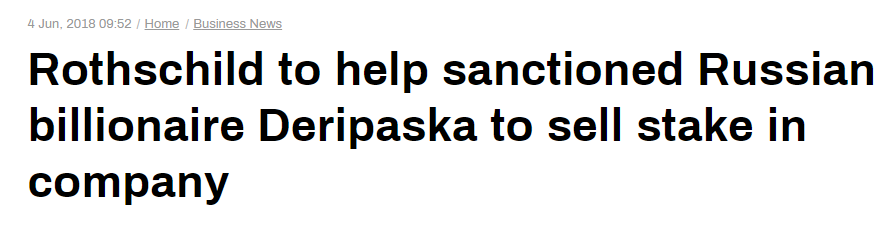

Though to be fair, I do believe Russia like any country does have some Rothschild agents, although they don’t accomplish much or end up exiled. For instance, the ‘oligarch’ Oleg Deripaska was known to have had Rothschild connections:

His own wiki page emphasizes how particularly close to Nathaniel Rothschild he is:

But Deripaska is the cretin Putin once famously compared to a cockroach on video while humiliating him:

Not to mention ordering the seizure of the oligarch’s properties after the start of the SMO:

The Western press however continued to weave tales of Putin-Deripaska’s putative closeness, despite the fact that Deripaska accused Putin of “not even trusting him with a pen”. In truth, I do think Putin had kept him close at times—while effectively weakening him, since Deripaska’s ranking dropped from #1 richest in Russia during the oligarch-rampant days, to outside the top 10—for the same reason stated before: Putin likes to keep enemies close and the most dangerous people on a short leash; it’s how an effective manager monitors the pulse of important intrigues and undercurrents.

Getting back to CBDCs, a lot of people fear the digital currencies for good reason. I myself wrote an article condemning them on my other newsletter, and I’m about as anti-government/establishment/globalist as they come. But only the ignorant use blanket generalizations to paint every seemingly related contrivance with one brush; each should be examined at its own truth and essence.

The reason we fear CBDCs is because they’re being used by the globalist financial cartel in a plot to control us, as part of their wider 2030 totalitarian agenda. This would be done, hypothetically, in a variety of ways, allowing them to eventually ban cash and use only traceable CBDCs, as well as program the CBDCs to serve finance capital’s interests; e.g. increase the ‘money velocity’ of a banking system by putting timers on the currency, forcing you to spend it within a given deadline rather than hoarding it in your savings.

But recall what I just explained—the Russian central bank is not connected to Western financial institutions and the giant presumably-Rothschild banking system of the globe. Private capital and corporate banking institutions don’t own the Russian central bank, they have no stake or share in it whatsoever, unlike in the Western institutions. Hence, any CBDC created by Russia’s central bank in fact serves only the Russian state. Further, they’ve expressly stated that the digital Ruble will not replace cash—though admittedly, none of us take governments at their word when it comes to such things, so I don’t blame anyone for balking.

But the Russian government has a history of listening to its people’s demands quite a bit better than those in the West. For instance, the government initially joined the bandwagon of vaccination and attendant restrictions during the pandemic, but after outcries most of it was done away with. That’s how healthy governance should work. No one is suggesting governments should always be perfect and never introduce bad ideas, but what we as citizens demand is that if bad ideas are contrived, then after voicing our rejection of them, they should be summarily removed. The Russian government did that thus far—at least for the most part. There remain some bad apples within the structure who continue pushing certain nefarious agendas, whether it be vaccination or digital certificates, etc., but you’ll never get a completely amenable system unless you yourself institute total Orwellian control; there will always be bad actors.

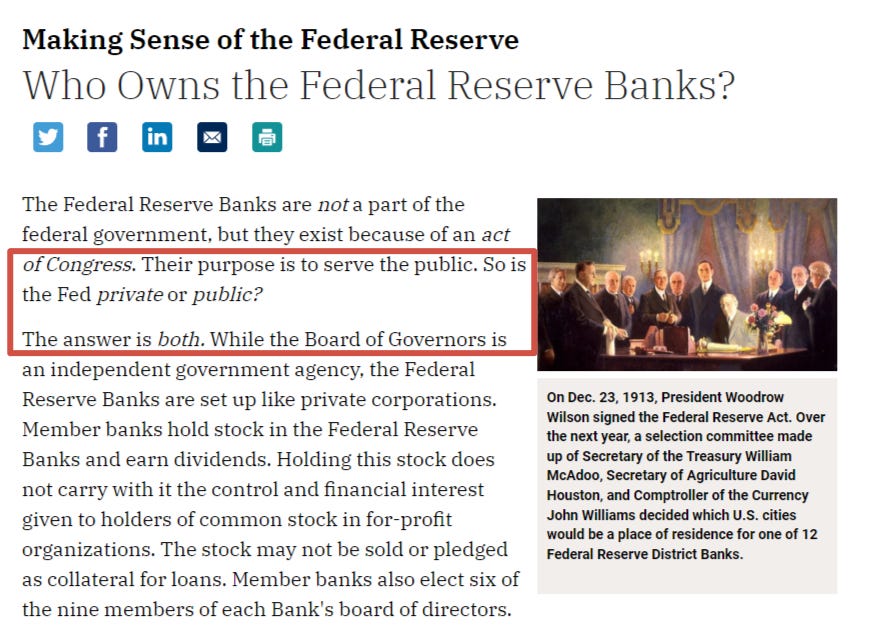

But getting back to the Bank of Russia, some argue that in its charter it states that—like the Federal Reserve of the U.S.—it’s an ‘independent’ institution. That’s true, but its definition of independence is different than that in the West. Too many people inculcated on Western paradigms try to crudely apply them to Russian systems without understanding the nuances. The charter also specifically states that the Russian bank is a ‘public’ institution rather than private one, but detractors ignore that part. Recall that the U.S. Fed openly admits that it’s “both private and public” and uses a “dual system”. You can see for yourself on their official site: “…a blend of public and private characteristics.”

And here is the official site of the St. Louis Federal Reserve, one of the 12 regional banks which comprises the U.S. Fed, stating plainly that they are both private and public.

On the official page for Russia’s central bank it says that, though a separate authority, it is a public legal institution. In fact, Article 15 of the Federal Law on the Central Bank even states that the CB directors cannot keep or open any foreign bank accounts.

The above Forbes article from earlier this year underscores some of my points, stating: “Today Russian banks are mostly state-run. The biggest commercial lenders are all state-controlled.”

In fact, the article bemoans how Bank of Russia head Elvira Nabiullina yanked the licenses of a bunch of zombie commercial banks or bought them up under state control, consolidating Russia’s state power over the banking industry.

“You have two big Russian banks that can be called private – the first is Alfa Group and the other is Moscow Credit Bank which is also quite big, but it was obvious that neither of them would be interested in buying Otkritie or the National Bank Trust which the central bank had on offer. Only the state-controlled banks are buyers of the banks the RCB took over since 2017,” he says. “I think the situation is stable now and Nabiullina can influence people in the Russian government to not change anything. If it is not broke, don’t fix it.”

Nabiullina’s performance in saving the Russian banking system is up for debate. She did save it, but she put it in state control.

Then there’s this shocker:

In 2014, there were 923 commercial lenders in Russia. Last year, some 370 remained in business. RCB data shows over 600 private banks have lost their licenses under Nabiullina’s tenure.

Read this very carefully:

“Nabiullina has completely destroyed the private banking system of the Russian Federation. Due to her activities, it collapsed into one big state banking system, controlled by Nabiullina herself and her people. She has been performing her activities since 2013, consistently closing private banks”, a financial sector source said in Moscow.

Interesting, wouldn’t you say? And given the fact that Nabiullina is Putin’s chosen, who served as his previous personal economic advisor, we can only surmise that this was a Putin operation through and through, to destroy the Western banking cartel influence over Russia and centralize Russian banking under the state, as it should be. The article even mentions how Putin “personally approved” of one of the big stated bank sales, lending credence to this angle, and also support to the idea that Putin was supervising Nabiullina’s hatchet job on the Western-owned-and-invested financial industry.

Note how Russia peaked in its number of ‘credit institutions’, i.e. private banks, during the lawless post-Soviet collapse where Western finance completely took over and gutted the country. Western banking institutions flooded through Russia like a Wild West free-for-all. Then after Putin took over, the number of these institutions has gradually been dropping. In fact, the chart above goes only to 2015, and shows 600+ institutions at that point. Currently, Russia has dropped to a mere mid-300s. Do you see what’s happening?

Admittedly, a similar down trend is seen in the West. For instance, the U.S. had something like nearly ~20,000 financial institutions in the 80s, which dropped to ~6000 at the present. However, that came about by way of bank failures and endless mergers, where the biggest conglomerates continued gobbling each other up to get ever more powerful. It wasn’t, to my knowledge, a result of a deliberate campaign to cull the banks like in Russia.

Naturally, citing ‘financial experts’, the Forbes article laments these moves, characterizing them as some kind of reversion of Russia into a ‘primitive banking system’ which is meant to harm the nation in some way. Yet time has proven the sagacity of these actions, given that Russia has just officially surpassed Germany and moved to #5 on the world GDP PPP rankings, and has some of the best economic numbers in the world, insofar as inflation, unemployment, account balances, debt to gdp, and many other indicators. Clearly, they’re doing something right.

But getting back to CBDCs. If the Russian CBDC is meant to serve some kind of outside interests, whose interests is it serving exactly, if the Russian central bank has no connection to the Western system, apart from the obligatory trade settlements between two states and the requisite currency conversions, etc. It’s clear that the Russian banking industry is far more under the yoke of the state than in any Western country.

I’ve established that the Russian central bank is no longer a member of the BIS or SWIFT system, its board members are not part of any ‘international’ corporation like the directors of Western central banks. So why would their CBDCs serve Western or international institutions of any kind?

There’s simply no mechanism by which they could do so, even if they wanted to. In the U.S. Federal Reserve system, the money flows directly to the member commercial banks who are the direct shareholders of the Federal Reserve system. And as everyone knows, a corporation’s board of directors is beholden to its shareholders. That means the incentive flow is clearly for the board members of the Fed to serve their clients’ interests. Sure, they claim to check this by having different ‘classes’ of board directors, with Class B for instance meant to ‘represent the public’. Yet as you can see in the earlier graphic I posted, Class B directors are still CEOs of major corporations, not to mention that they’re still ‘elected’ by the actual member banks. JP Morgan electing the CEO of IBM as the exemplar ‘public representative’ is the height of absurdity, and is actually an outright mockery of the people.

Since we know the Federal Reserve system is simply an extension of international megabanks, any policy the Fed institutes, like the roll out of a prospective CBDC, is likely at the behest, and for the benefit of, international interests which have nothing in common with U.S. citizens. That means the foreign controllers who actually own and dictate policy to the JP Morgans, the AIGs, etc., will push CBDCs because it benefits them and their secret top-of-the-pyramid institutions which are certainly not based in the U.S.

How does this work? For instance: we know that the U.S. Federal Reserve is comprised of 12 member Fed banks, like the NY Fed. Each of these member banks is comprised of a multitude of private megabanks like JP Morgan and co., who own the shares of the NY Fed and elect its board of directors from within their own corporate milieus—which means the Fed banks are entirely controlled by them.

But JP Morgan et al, are U.S. banks, you say. So they must have the interests of U.S. citizens in mind, right? But who owns JP Morgan? If you look at the actual institutional shareholders who own the controlling shares of JP Morgan, they are BlackRock, Vanguard, etc. BlackRock is a giant ‘corporation’, or rather fund manager, which is ostensibly U.S.-based but is obviously a global-international company. Not only are several of its own board directors foreign, like two Saudi Arabian oil barons, a Canadian CEO, etc., but some of the corporations which hold controlling shares in BlackRock itself are foreign, like Singapore-based Temasek.

Secondly, all of the companies and portfolios that BlackRock manages—which is pretty much all of them—are international in scope, making BlackRock beholden to them and their interests, not merely U.S. citizens. Also, for the record: BlackRock is a publicly traded company while Vanguard is not, which means Vanguard’s private shareholders are completely secret and can never be revealed. And recall that Vanguard has the controlling share of BlackRock. So the company that owns the controlling share, and therefore the largest voting rights, in BlackRock, and thereby owns the vast majority of every major bank on the planet including the Federal Reserve, is itself owned by a ‘secret’ cabal of shareholders.

We have no way of knowing who they are, but we can probably guess. Other researchers like Mullins and Gary Kah have narrowed them down to a few ruling banking dynasties: Rothschilds, Warburgs, Goldman Sachs, Rockefellers, Israel Moses Seifs, Lehmans and Kuhn Loebs, Lazards, etc. And by the way, the whole point of the Federal Reserve Act famously hatched in secret on Jekyll Island—at least according to experts like G. Edward Griffin, who’s studied its genesis for 70+ years—was to create exactly such a system, where the top few families can form a cartel to control the banking industry together, while protecting their interests from competition; in short, a monopoly amongst their small syndicate of inter-related and inter-married generationally dynastic families.

Getting back to our argument, when you trace the lineages of these ownerships, you get to an increasingly internationalist scope which has the interests of international finance in mind. So when a system like the U.S. Federal Reserve is based on this foundation, any instruments issued by it, like CBDCs, can be assumed to be designed around the above interests.

But given that the Bank of Russia has no such ownership, no shareholders of any kind, nor connections to international corporations, that means none of the above arguments pertain to Russia’s CBDC. In fact, it can even be argued that the Bank of Russia’s CBDC is a weapon against international finance, given that it’s already been an established point of concern by Russia’s other commercial banks—the few remaining that there are—that the CBDC will cause major losses in profits for them. The reason is obvious: Russian citizens who choose to open up ‘digital Ruble’ accounts directly with Russia’s central bank will represent lost potential customers for the commercial banks vying for those same accounts and deposits. I’m not making that up—this has been an actual reported concern from the commercial banks to the point where the Bank of Russia even had to assuage them with the reminder that most customers will still prefer to keep accounts with them as well, given that digital Ruble accounts at the Central Bank will not accrue interest as they do in commercial banks. Thus, normal people wanting to actually make a profit on their savings will still need to open accounts in regular commercial banks. From the above linked article:

The launch of the digital ruble may lead to an outflow of 4 trillion rubles from Russian banks and a rise in the cost of loans, according to the country's largest bank.

Sberbank has assessed the risks of launching a digital ruble and expects 2-4 trillion non-cash rubles to be transferred from banks to the Russian digital currency after its introduction, Deputy Chairman of the Sberbank Management Board Anatoly Popov said at a press conference.

When you’re making commercial banks nervous and envious, you’re probably doing something right.

This proves there’s actually more argument toward the side of Russia’s CBDC harming private commercial banks and their interests than the reverse, given everything I’ve explained above, particularly given the evidence that Putin has utilized Nabiullina and the central bank to smash and curtail private corporate bank interests in Russia. Admittedly, it’s likely a very far stretch along the Putin-5D tract, but it’s even remotely possible that the Bank of Russia CBDC is part of a long term plot to completely wrest control of Western/London-based finance and return it to the people. But such a hypothetical plan would only work on a long term timescale in conjunction with several other critical developments, like the Russia-China multipolar revolution upending the entire financial architecture of the globe, or at least their sphere, and returning the world to real asset backed currencies. But that would be in the realm of NESARA-GESARA level improbability, at least for any time in the near future. However, I do think it’s trending there and everything will depend on the next line of successions in Russia after Putin.

So, does this mean we’re supposed to love and trust Russia’s CBDC? Not necessarily, I myself still remain healthily skeptical. The reason being that even though it remains seemingly innocuous for the time being, this can all change in the future. For instance, a pro-Western/liberal politician could hypothetically succeed Putin and decide to completely reorient Russia in the direction of the ‘Great Reset’, then militate towards turning CBDCs into everything they were feared to be.

Nor is this supposed to be a resounding endorsement of Russia’s central bank system or any central banks for that matter. In general, I still remain personally critical of any type of banking institution of the Western usury-fiat mold. But the Russian one certainly appears to be the best of the batch. And like I said, there’s a chance that Putin is conducting a long drawn-out personal crusade to slowly reform the entire system, with the end-goal being a real gold or asset-backed currency, used by the entire nascent resistance/multipolar sphere as represented by the BRICS.

In fact, a small but interesting bit of news flew under the radar just days ago. Putin signed a law for an experimental series of ‘Islamic banks’ in four key Russian regions, which have a higher Muslim population; namely Dagestan, Chechnya, Bashkiria, and Tatarstan. This trial would run for two years, until 2025, and would prohibit using the bank to finance tobacco, alcohol, weapons, gambling, etc. Most notably, however, it would prohibit the usage of interest rates in any loans or transactions.

You read that right: the prohibition of usury. How do you loan money without an interest rate, or rather, for what incentive? I’m not sure, but it seems to have something to do with this, from the above linked article:

There is a condition of sharing the risk of profit and loss between the financing party and the client on transactions and financial transactions based on actual assets or transactions with these assets. It is also necessary to identify the actual assets underlying the transaction.

It’s clear that the most epochal global seachange that could happen in our lifetimes would be the dissolution of the Western fiat banking system which has controlled the globe for hundreds of years, and on which the pillars of the most toxic forms of crony capitalism were built. But also specifically, the dollar as reserve currency and its attendant ‘exorbitant privilege’, which has fueled the unipolar model of the world for decades, unleashing a wave of unfettered imperialism that drowned the developing world in oceans of blood, felled countries and continents alike, turning them into broken, impoverished, lawless slave-pits—like for example Libya, and many others.

Could the Russian CBDC be a tactical foray against this system, as its progenitors claim, or will it be co-opted by the powers-that-be into another instrument of societal control? It’s difficult to be certain, but for now I retain a modest hope, for the reasons outlined in this article.

What do you think? Share your thoughts below.

If you enjoyed the read, I would greatly appreciate if you subscribed to a monthly/yearly pledge to support my work, so that I may continue providing you with detailed, incisive reports like this one.

Alternatively, you can tip here: Tip Jar

By the way, any semioticians or astrologers have an opinion on the digital ruble symbol? Seems to me like Pluto the destroyer or representing 'rebirth', which is ...interesting

solid research

great stuff

keep it up 👍