Some really interesting developments are happening apropos the banking and financial situation in Russia and the world.

Firstly, to set the stage: there’s the rumor going around that Saudi Arabia has allegedly declined to renew its purported “50-year Petrodollar deal”, signed—again, allegedly—on June 9th, 1974.

The problem is, there is no actual valid source reporting this: if you trace it down to its roots, it is originating from a bunch of fake obscure websites, like the old Sorcha Faal whatdoesitmean dot com types.

Sure, some fairly legitimate sites like Gateway Pundit are reporting it, but they are merely echo-chambering the story without a valid source. So, unfortunately, this story appears to be mostly fake. However, I think it’s mainly riffing on real events that have already been taking place. There doesn’t seem to be any precise 50 year deadline that just happened to expire days ago, but rather Saudi Arabia has already signaled that the deal is in effect null and void over the course of the last few years.

But the reason the story is actually extremely relevant either way, despite being a somewhat phony formulation of real ongoing events, is because of the other huge developments that are now breaking ground as we speak, and how the Saudi Petrodollar critically plays into it.

Now the big story revolves around the G7 meeting and the sudden new sanctions package levied on Russian stock markets with the intent to crash them:

A new round of US sanctions targeting Russia's Moscow Exchange (MOEX), National Clearing Centre and National Settlement Depository will further undermine the dollar's role

But instead, Russia took the USD and Euro completely out of trading, and a large storm now appears to be brewing in the global financial markets.

In the wake of the US Treasury move, the Russian Central Bank announced that exchange trading and settlements of deliverable instruments in US dollars and euros were to be suspended, adding that these operations would be continued "over-the-counter (OTC)," i.e. directly between Russian banks and their customers. The bank clarified to Russians that their foreign currency deposits remain secure despite sanctions.

Coupled is the fact that at this key moment the G7 attendants decided to begin utilizing Russia’s stolen sovereign funds to give to Ukraine. But, firstly, there’s a catch: they’re not using the funds themselves, but rather the “interest accrued” from holding those funds, which amounts to $50B for now. And on top of that, the money is apparently comprised mostly of loans, for which the funds are used as collateral.

Ursula proudly announced the sovereign fund theft:

According to senior Biden administration officials, the loan will become active later this year, and will effectively make Russia pay for it vs. US taxpayers and G7 countries.

"Russia pays," said one official. "The income comes from the interest stream on the immobilized assets, and that’s the only fair way to be repaid. The principal is untouched for now. But we have full optionality to seize the principal later if the political will is there."

As you can see, they’re not actually touching the principal—but rather creating a loan instrument; standard trick-o-the-trade from the loathsome usury cabal’s occult magic bag.

But even this effort is already facing roadblocks:

Here’s where it starts getting interesting. As I said, Russia immediately retaliated by pulling the Euro and USD, which had a number of repercussions. Firstly, the Ruble for now has risen dramatically to 87 against the Dollar. Next, Russia announced another initiative for the Yuan to replace the Dollar entirely:

Here’s one analyst’s long but very detailed summary:

The Bank of Russia and the Moscow Exchange have been preparing for sanctions since March 2022, response protocols were formalized in September 22, implemented in October 22, and adapted throughout 2023. Revisions have been taking place since 2024, so there are no surprises and everything should go relatively painlessly.

The main adaptation involved the establishment of correspondent accounts with Chinese banks, the deployment of infrastructure for Yuan trading and the expansion of the over-the-counter market.

The share of the yuan in May reached another historical maximum in the structure of the foreign exchange market, reaching 53.6% vs. 1% at the beginning of 2022. Over 99% of the trading turnover is occupied by the yuan, dollar and euro.

The share of the over-the-counter market in the total volume of foreign exchange trading was 58.1% in May (in April – 56.4%). In the over-the-counter market, the yuan's share rose to 39.2%.

There will be no paralysis of the foreign exchange market, because turnover will move to the shadow circuit of the over-the-counter market - transparency will decrease, spreads will widen, commissions will increase, and liquidity will worsen. There is nothing good and there is not a single positive aspect, but from the point of view of the survival of the system, the fundamental risks are covered.

In the short term, panic may increase demand for dollars and euros, but in the medium term, demand will likely decline.

The most significant part of the analysis:

In 1Q24, exports in the currencies of unfriendly countries accounted for 21.5% vs. 86% at the beginning of 2022, and for imports – 27.8% vs. 66% at the beginning of 2022. In the next 6 months, the demand for the currencies of unfriendly countries in foreign trade activities may decrease further, but not to zero, because The principled position of many counterparties is to settle exclusively in “hard currency”.

So the usage of unfriendly currencies has already plummeted from 86% to 21.5% since 2022, and now will plummet even further with the latest actions.

But before we move on to converging developments, the short to medium term risks are real:

What consequences may arise from the cessation of trading in dollars and euros in Russia?

The risk of a collapse in exports and imports will increase by 10-25% in the next six months due to the inability to pay for foreign trade transactions in dollars and euros , which could lead to a shortage of critical imports, slowing down investment activity. Export revenues may fall. Scenario of Iran in the first years after tough sanctions.

A shortage of imports can exacerbate inflationary processes within the Russian Federation due to a surplus of the ruble money supply and the absence of points of distribution of the money supply.

Theoretically, settlements under foreign trade contracts can be carried out outside the Moscow Exchange through various mechanisms of the over-the-counter market, but everything depends on the specifics of the contracts. Large counterparties will avoid such schemes.

There is no understanding regarding the functioning of the National Welfare Fund, the fiscal rule and the mechanisms of foreign exchange interventions - we are waiting for clarification from the Bank of Russia.

There is a risk of degradation of foreign exchange transactions with China due to fears of secondary sanctions . There is a non-zero probability that large Chinese banks will avoid any interaction with the Moscow Exchange, NCC and NSD, having experience of limited participation in currency integration in the absence of sanctions. It is likely that special representative offices will be allocated in individual small Chinese banks for financial communications with Russia.

The United States is strengthening extraterritorial control over compliance with sanctions, which includes counterparties from the CIS countries, the UAE, Turkey and Hong Kong, which, unlike China, comply with the sanctions regime more carefully.

There is a risk of establishing a dictatorship on the part of China, as the only counterparty through which Russia will have contact with the outside world, which will limit Russia’s sovereignty within the framework of determining foreign trade and foreign economic activity. Such a disposition imposes restrictions on both trade and investment operations of Russia in the outside world, when almost any external transaction can take place with the direct approval of Chinese functionaries.

Foreign exchange costs will increase, and the timing of transactions will lengthen - this will directly affect through significant lags in deliveries and settlements (accumulation of receivables from Russian counterparties).

Shortages of Dollars and Euros may affect the ability to fulfill external obligations to creditors and investors, which are slightly less than fully denominated in the currencies of unfriendly countries (external debt). Although external debt has decreased by more than 40% since the beginning of 2022 (353 -> 208 billion), this factor cannot be written off. Before the sanctions, Dollars and Euros were hard to find during the day, and even more so now.

There is already experience of blocking sanctions on a large country (Iran) and nothing good can be seen: barter transactions and direct exchange of goods, shadow financial schemes and intermediaries, which increases costs, smuggling, but still the use of cryptocurrency is increasing. In any case, the consequences are obvious: slowdown in trade turnover, smuggling, rising costs.

The growth of foreign trade in the national currency (Rubles) is inevitable, but with its own specifics - there are quite a few people willing to accept rubles and in a limited volume - the CIS countries, China, partly India, Iran, some countries in Africa and Latin America (the latter have an insignificant trade turnover).

There is a risk of the emergence of a “two-level” foreign exchange market – the official exchange rate and the “black” exchange rate.

The BRICS payment system will certainly lead to the improvement when its up and running.

As can be seen from the above, there are a slew of medium term worries. However, the golden opportunity lies in the fact that we stand at a grand pivot point of history, the 4th turning as some call it. Russia has the BRICS chairmanship and is expected to push the initiative for a BRICS currency and a new reformatting of the entire global system.

The BRICS ministers met in Nizhny Novgorod on June 10th and issued the following key points to give us a taste of what’s to come, summarized by Arnaud Bertrand:

Comprehensive reform of the UN: They "support a comprehensive reform of the United Nations, including its Security Council" with a view to making it more democratic and "increase the representation of developing countries in the Council’s memberships"

Comprehensive reform of financial system: They "recognize the need for a comprehensive reform of the global financial architecture to enhance the voice of the developing countries and their representation in the international financial institutions." Crucially they also "underscored the importance of the enhanced use of local currencies in trade and financial transactions between the BRICS countries."

Calling out Israel and backing Palestinian statehood: "The Ministers expressed serious concern at Israel’s continued blatant disregard of international law, the UN Charter, UN resolutions and Court orders." They also "support Palestine’s full membership in the United Nations" as well as "the establishment of a sovereign, independent and viable State of Palestine in line with internationally recognized borders of June 1967 with East Jerusalem as its capital".

Condemning "unilateral coercive measures" and protectionism: They didn't name the US, but this section leaves no doubt as to who they were referring to: "[The ministers] expressed concern about the use of unilateral coercive measures, which are incompatible with the principles of the Charter of the UN and produce negative effects on economic growth, trade, energy, health and food security notably in the developing world." In the same vein they also "opposed unilateral protectionist measures, which deliberately disrupt the global supply and production chains and distort competition."

Number 1 and 2 in particular jibed with other points about reforming the WTO and the G20—which will be chaired by BRICS nations from now until 2025—as well as focus on the usage of native currencies:

The Ministers underscored the importance of the enhanced use of local currencies in trade and financial transactions between the BRICS countries. They recalled the paragraph 45 of the Johannesburg II Declaration tasking the Finance Ministers and Central Bank Governors of the BRICS countries to consider the issue of local currencies, payment instruments and platforms and to report back to the BRICS Leaders.

Thus, the focus is being increasingly put on dedollarization at this pivotal moment just as the world bears witness to the financial criminality and unethical conduct of the ‘Rules Based Order’. This also happens at a time when dozens of new nations are applying to join the BRICS and at the 16th BRICS summit in October of this year, it is expected that another slew of countries will be accepted as members.

As we can see, BRICS is currently holding its own version of the Olympic games in Russia—the largest ever thus far—in parallel, and as alternative to, the Paris summer games set to begin soon. Little by little, BRICS is creating an alternate fairer vision of the world where coercion, cancellation/deplatformization, and theft of sovereign funds is not a viable weapon. The pace is starting to pick up rapidly, and within a few years the Western model may be in dire straits as the entire world flocks to the positive vision that the Chinese and Russian-led order offers.

Now FT reports due to the West’s precarious financial weaponization, countries have cut their Euro assets by 5%:

The euro’s share of global foreign exchange holdings fell last year amid concerns that plans to use frozen Russian assets to finance Ukraine could further erode the appeal of Europe’s single currency.

Other countries cut euro assets in their central bank reserves by about €100bn last year, a drop of nearly 5 per cent, the European Central Bank said in a report published on Wednesday. The Euro is has fallen to a 3 year low of 20% and down from 25%. With it's share of trade falling 0.7%

The ECB warns that “weaponising” currencies only makes them less attractive, endangers the ability of the EU to issue debt cheaply. With EU members holding €13.8 trillion ($14.7 trillion). Half a % (50bps) is nearly €70B more EU countries would spend on interest payments in a year.

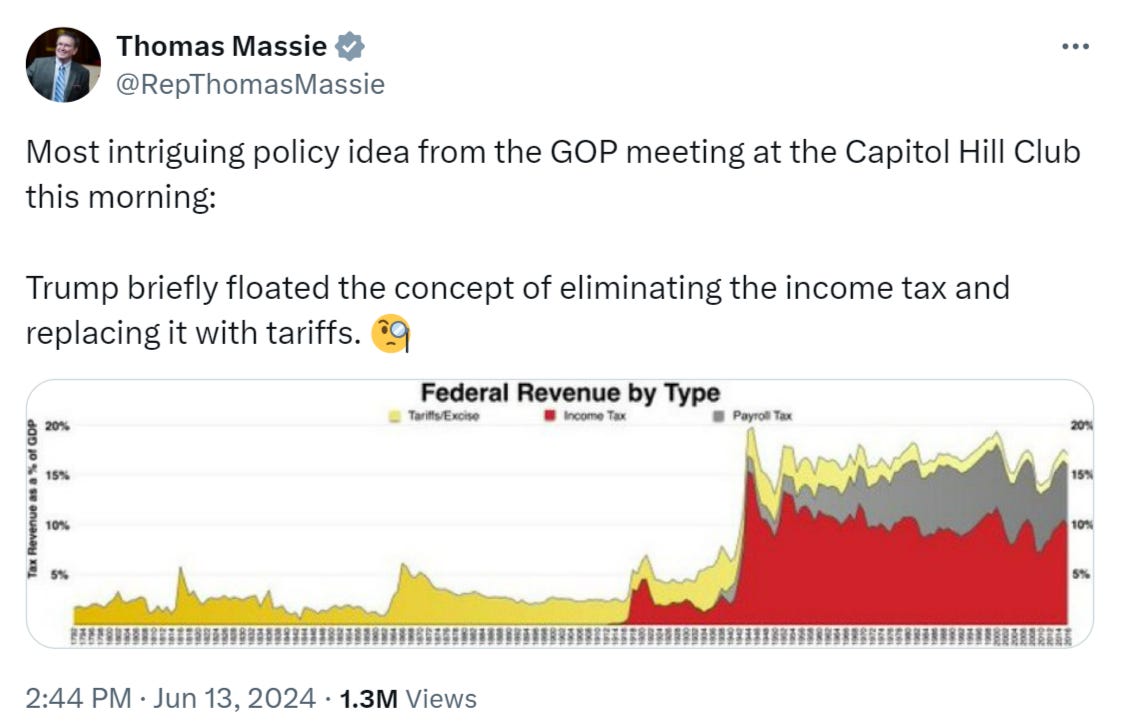

And in a bombshell, House rep Thomas Massie reports that Trump is floating the complete abolition of the income tax if he takes office:

Suddenly the old kook Nesara/Gesara theories aren’t sounding so crazy after all.

In short, all the current snowballing events are gearing up to potentially effect a massive black swan moment in 2025, which may shake the foundations of the entire Western financial system off its rails. And that’s where the Saudi situation comes in: KSA now sports full BRICS membership and has previously signaled willingness to accept Yuan for oil sales to China, so we know—at the least—the suggestion of Petrodollar demise is not conspiracy theory:

The big question is not where things will go, but how fast: their trajectory is nearly certain, it only remains to be seen how quickly the BRICS-adjacent countries can agree on mechanisms and muster the initiative to implement them into actual practice.

For decades the idea of abandoning the Dollar seemed ludicrous, particularly to smaller, less powerful nations who do not possess as much agency as a superpower like Russia. But now that Russia is showing them the way, pioneering the path forward and demonstrating there is nothing scary about breaking through that mental barrier of imposed colonial slavery and financial hegemony, we can expect the remainder of the world to quickly follow Russia’s lead; once the specter is shattered, it is akin to breaking through a psychological support floor or resistance ceiling in the stock market, after which things can plummet or skyrocket with an unpredictable runaway velocity.

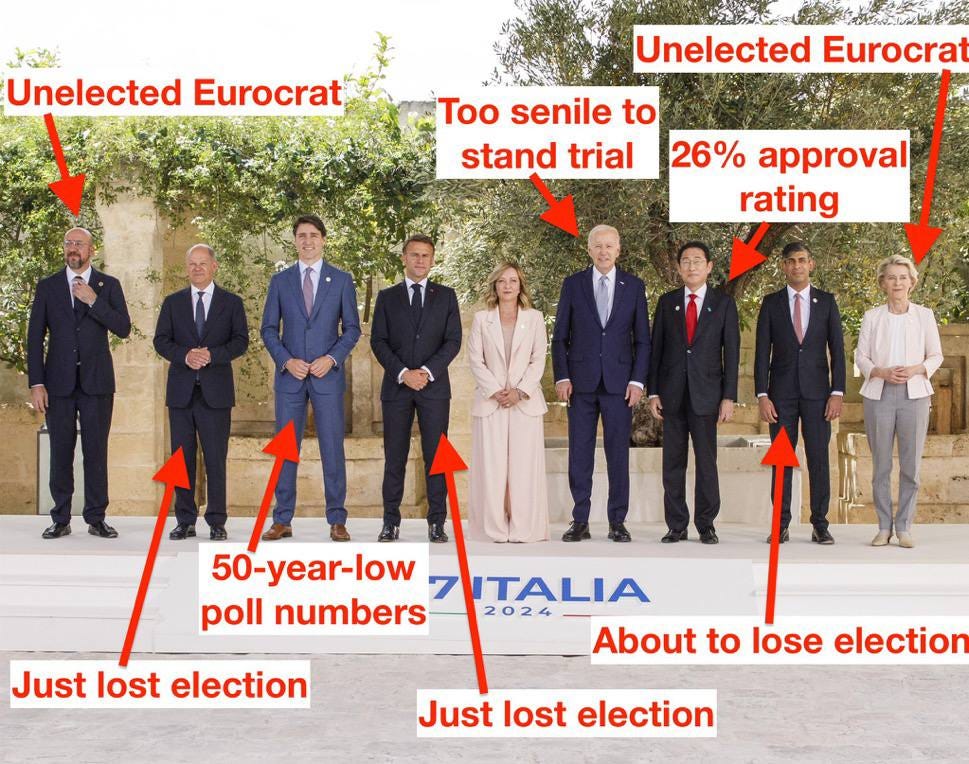

In essence, the idea being conveyed is that we’re coming upon a time where it seems everyone is doubling down, going all in with their trump cards and ‘showing their hand’ in the parallel financial shadow war raging beneath the surface of the kinetic one. Russia clearly isn’t begging forgiveness and has instead doubled down on the dedollarization acceleration drive. It’s only a matter of time before things begin to unravel for the side left holding the skimpy cards, or whose bluff is called. Given that Russia and China’s fundamentals are sterling compared to that of the West—and in particular the U.S. with its outrageously swelling 126% debt-to-gdp—when it comes to debt structure, economic growth, unemployment, inflation, and all other key metrics, it’s clear to see who will be left with their pants down in the near future. That’s not to mention the bloodbaths we’re witnessing in global politics, with the deepstate-controlled factions taking a hiding, which will only be culminated by the Democrat’s presidential loss in 2024. In almost every way conceivable, 2025 stands to be a historic turning point year.

As a final great summation of the utter absurdity of the decaying West’s terminal folly as they desperately subvert the most fundamental strictures of their own poisoned financial regime in the most egregiously illogical and nonsensical way while drowning in the self-created toxicity of their criminal insanity—from SwanEconomy on TG:

The financial scam of the century is on its way: the EU is ready to become the main culprit at the behest of the US

The world will soon see the largest theft of money in history. Before our eyes, the main customer (the US) together with the executor (the EU) are now trying to disguise the theft of the "frozen" part of Russia's sovereign assets as much as possible as a legal transaction.

There is already a preliminary consent of all members of the G7 countries.

What is going on? The US intends to provide a $50 billion loan to the Kiev regime. The task of the Europeans is to transfer the "frozen" assets of the Russian Federation in the amount of about 260 billion dollars to the status of financial collateral (pledge) under the American loan.

The reasoning that only income from the $260 billion in assets will be used to secure the U.S. loan cannot be taken seriously: the amount of collateral must be at least as large as the size of the loan. It is obvious that the income from the assets is much less than 50 billion dollars.

At the same time, Washington does not intend to transfer any money to Kiev. They will be given to the American military-industrial complex for the production of weapons.

In this case, the Europeans will have to take on the dirtiest job: it is essentially to steal the assets of the Russian Federation, and then transfer them to the United States, but within the framework of a supposedly "legal" scheme. All the risks involved, as well as prosecution, as they believe in Washington, will concern only Europeans, but not Americans.

After all, what do we see from the point of view of financial market specialists? The U.S. intends to give a loan to a country whose sovereign debt rating is below the plinth. That is, it is knowingly giving a loan to a debtor who will not pay it back. This is either insanity or some kind of money laundering scam.

However, the times higher collateral should, from Washington's point of view, make such a loan as if not questionable. But for this to happen, the U.S. authorities need the Europeans to change the status of Russia's "frozen" assets to having the nature of collateral.

In the situation of the country's failing credit capacity, no one, unless it is a criminal scheme, will give a loan only against "income from assets" if there is no guarantee that the creditor can get the assets in case the debtor fails to repay the loan.

The world remembers very well that after 2014 the Ukrainian authorities did not give Russia a $3 billion sovereign loan with interest. Of course, Kiev then did it by Washington's decision by the hands of the Supreme Court in the UK. But when debts have to be returned to Washington, here - different "rules", or rather - bandit arrangements.

Now the U.S. authorities' handmaidens in Europe have to "drag" the assets from Russia to the necessary legal "point" from which they will be put into the pocket of the U.S. authorities.

European politicians are made a laughingstock, because the decision for the same Belgian Euroclear, where the largest amount of Russian money is located, is made not even by the Belgian authorities, and not by the EU leadership.

The decision is made by the G7, which does not include Belgium and has no right to decide on issues that affect the reputation of the entire EU. The U.S. continues to humiliate its vassals, but it is already taking them over the edge, further displeasing the Europeans. And the beginning of political change is dawning in Europe.

Do you think the US and EU will lose the trust of the entire non-western world after the scam?

In short: the U.S. wants Europe to take on all the risk and liability in proportion to the amount of sovereign Russian funds they hold, while this is used as collateral to transfer the loan to U.S. defense contractors, who will enrich themselves on the behalf of impoverished Europeans—what a swell plan:

I can’t leave out the most hair-raising wallop of the whole occasion. From Dmitry Medvedev, one of his most truculently foamy invectives to date:

🇷🇺💬Dmitry Medvedev:

"Here are the new American sanctions. There will be new European ones soon. Do we need to respond to them? It seems not, their number is already measured in tens of thousands. We have learned to live and develop with them.

On the other hand, it is necessary. Not only for the authorities, the state, but for all our people in general. To everyone who loves our Motherland - Russia. After all, they - the USA and their darn allies - declared war on us without rules!

How to react? I already talked about this once, but it’s worth repeating.

Every day we must try to inflict maximum harm on those countries that have imposed these restrictions on our country and all our citizens. Harm to everything to which harm can be done. Harm to their economies, their institutions, and their rulers. Harm to the well-being of their citizens. Their confidence in the future. To do this, we must continue to look for the critical vulnerabilities of their economies and hit them in all areas. Cause damage in all places, paralyzing the work of their companies and government agencies. Find problems in their most important technologies and strike them mercilessly. Literally destroy their energy, industry, transport, banking, and social services. Instill fear of the imminent collapse of all critical infrastructure.

Are they afraid of handing over our weapons to the enemies of the Western world? We must transfer to them all possible types of weapons, except nuclear (for now)!

Are they afraid of anarchy and an explosion of crime in major cities? We must help disorganize their municipal government!

Are they afraid of war in space? This means they will receive it too. Let everything stop for them, let everything deteriorate, let everything go to hell!

Are they afraid of social explosions? Let's arrange them! We need to throw all the most ominous night terrors into their media sphere, and use all their terrible phantom pains. No need to spare their psyche anymore! Let them shiver in their cozy homes, let them shiver under the blankets.

Are they yelling about our use of fake news? Let's turn their life into a completely crazy nightmare in which they will not be able to distinguish wild fiction from the realities of the day, infernal evil from the routine of life.

And no rules regarding the enemy! Let them get everything in full for harming Russia and as painfully as possible! Everyone can contribute!

Remember:

Quid pro quo!

Tit for tat!

"fracture for fracture, eye for eye, tooth for tooth; whatever injury he has given a person shall be given to him"

(Leviticus 24:20)"

In fact, Medvedev wrote a whole article on the occasion for Rossiskaya Gazeta, echoing Putin’s abnegation of the infamous Vampire Ball:

“Humanity must finally get rid of the legacy of the colonial system. The time of the metropolises has expired”

The USA has become a global sanctions neo-metropolis, violating the sovereignty of third countries, and secondary sanctions are attempts to destroy entire countries;

The West artificially creates economic crises, uses the green agenda to maintain elitism, and through the monopoly of IT corporations drowns out those whose opinions contradict its guidelines;

It will be possible to rid Ukraine of the neo-colonial shackles of the West only after completing all the tasks of the special operation;

The Global South does not want to follow the “Zelensky formula” and sever long-term ties with Russia;

The West uses “debt neo-colonialism” to maintain influence in the Global South;

Armenia is promised “mountains of gold” in exchange for complete loyalty, but the doors of the “club of the elite” will not be opened to Yerevan;

Paris will try to maintain its hidden currency presence in Africa for as long as possible, this is vital for Macron;

Russia hopes that cooperation in the BRICS - African Union format will reach a new qualitative level;

The West will resist the eradication of neocolonialism; it is necessary to increase the interaction of all forces in the fight against this phenomenon;

Former metropolises still want to parasitize the countries dependent on them, only in a more sophisticated way;

The West fiercely reacted to the movement to fight neo-colonialism “For the Freedom of Nations!”, they tried to disrupt the founding congress;

The formation of a new system of international relations is a matter of the near future; there will be no place for sanctions, exploitation and lies in it;

More and more countries want to live in peace, without the legacy of the colonial system and according to the principles of sovereign equality;

The new polycentric world order will be pragmatic, diversification of connections is the key to economic stability.

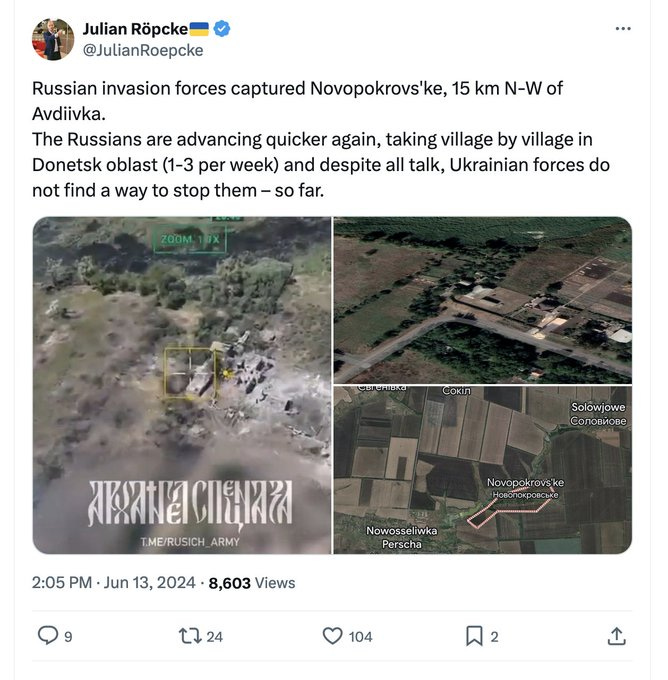

Russian forces continue capturing territory and settlements, as the usual suspects bellow in angst:

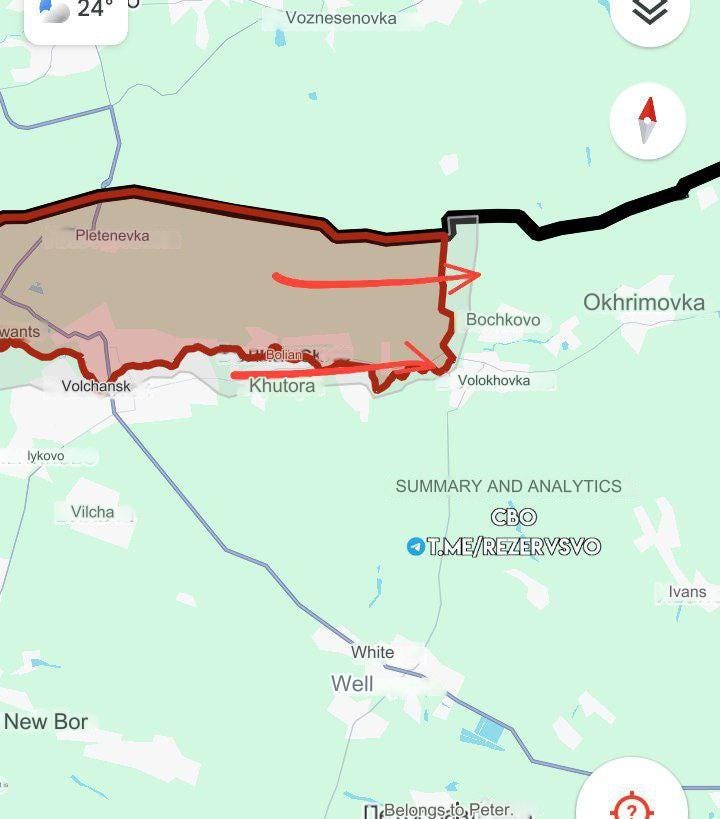

The Kharkov gambit is clearly working: Ukraine is now said to have transferred some of their best units from the Chasov Yar direction to Kharkov, so Russia is likely set to make big gains there soon as well. Despite Ukrainian claims, Russia has inched forward in Kharkov-Volchansk as well, which includes a large lateral advance—claimed to be 4km—to the east toward Bochkove:

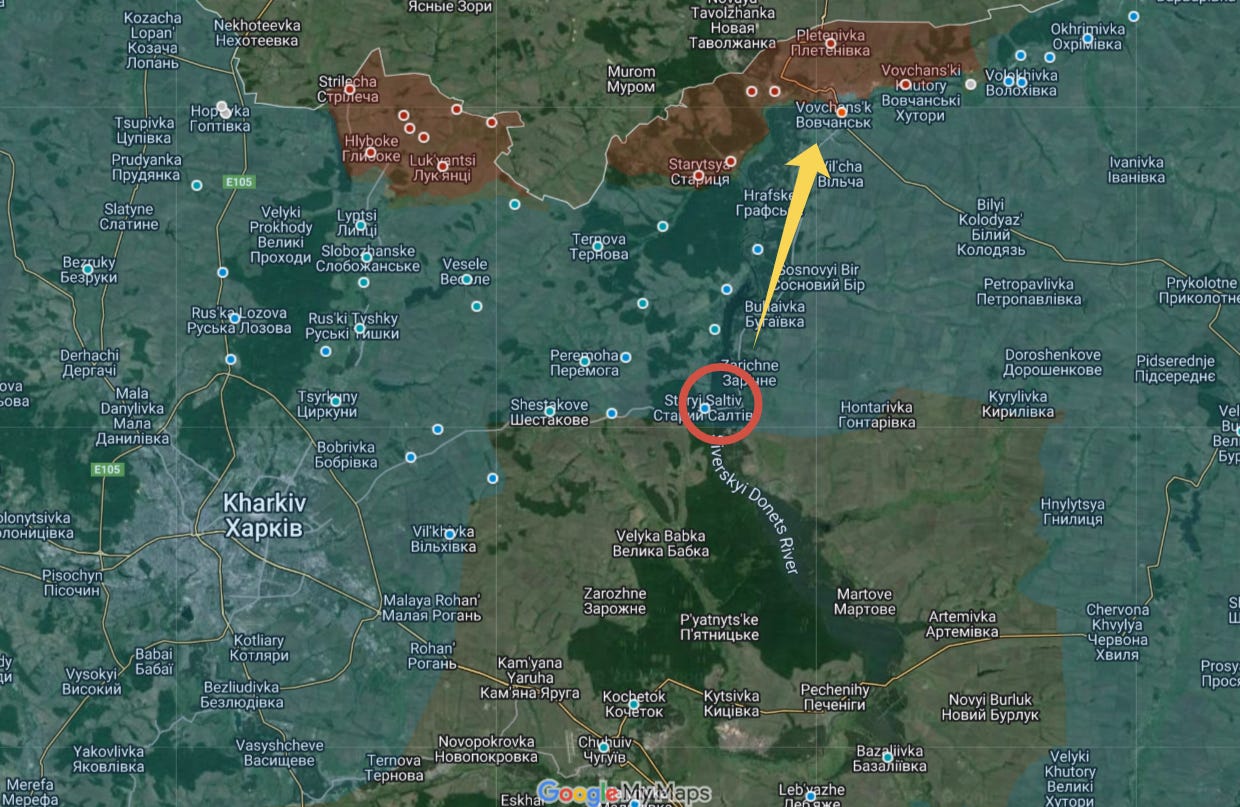

A Russian Su-34, in the meantime, used a Kh-38MLE missile to blow away the bridge at Staryi Saltov, connecting Kharkov to the Volchansk front, which will greatly hamper AFU logistics:

Location of bridge (50.07742223091243, 36.81082376840926) over the Siverski Donets River in relation to Volchansk and its MSR to Kharkov:

—

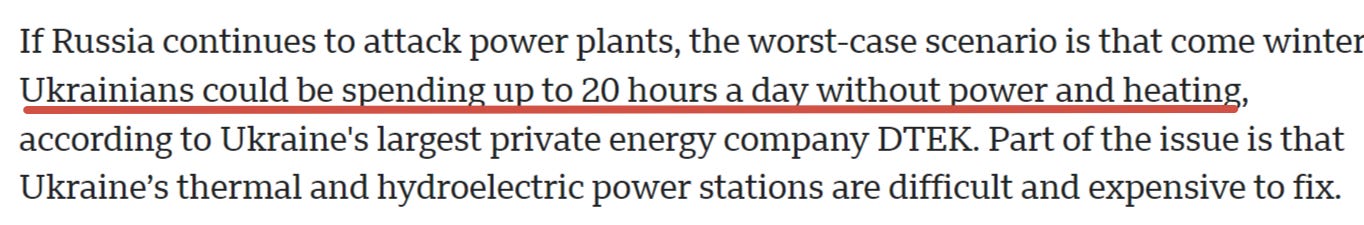

Ukraine’s power grid situation is beginning to seriously concern Western curators:

The above BBC article says Ukrainians already suffer 8 hour power outages and may soon face 20 hours per day without power or heat, should Russia continue its de-electrification strikes:

Ukrainian TV now even calls it “criminal” to run your air conditioner during the day:

For those interested, journalist John Helmer has a couple good pieces on this topic, the first is mostly a link to a podcast discussion thereof, where he states:

Right now the Russian Electric War campaign in the Ukraine is targeting the last operating power generation plants and the transmission lines from the European Union replacing electricity which the Ukrainians can no longer generate for themselves. Microwave and mobile telephone towers are being struck so that the country’s cell network is collapsing in parallel with the electricity network.

“This is Russian deep battle”, a US military source comments, “being fought in fact by the General Staff while its operations continue to be restricted in Moscow for political reasons. Soon the impact will be impossible to cover up. For now, we know how bad it’s getting by the lack of discussion about how bad it’s getting.”

The second is where he explicates on his opinion that Russia’s “electric war” aims to totally defeat Ukraine by de-energizing it: https://johnhelmer.net/buzzer-beater-russian-general-staff-aims-at-ending-the-ukraine-by-electric-war

I mentioned in the comments section last time: Ukraine has a legacy Soviet carryover system of using its thermal power plants (TPPs) as the ‘central heating’ systems via a network of steam conveying pipes. Thus the loss of what now amounts to ~73% of their TPPs (73% of thermal power plants in Ukraine are inoperative, 62 power units at thermal power plants and hydroelectric power stations are not functioning, - Ukraine Prime Minister Denys Shmyhal.) means not only massive energy generation loss, but the total lack of heat come this winter. That means the coming winter will be one for the ages and only supports the theory that Ukraine may be on its last leg in 2025.

—

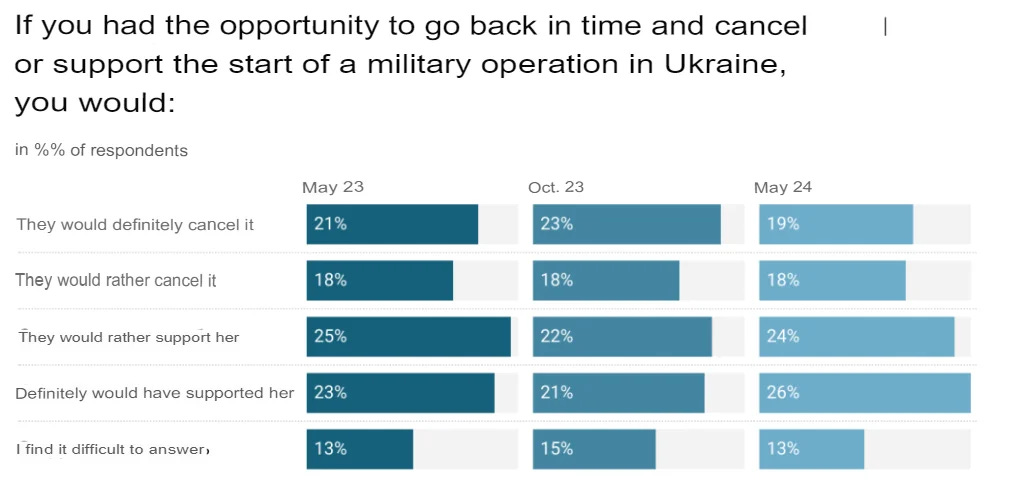

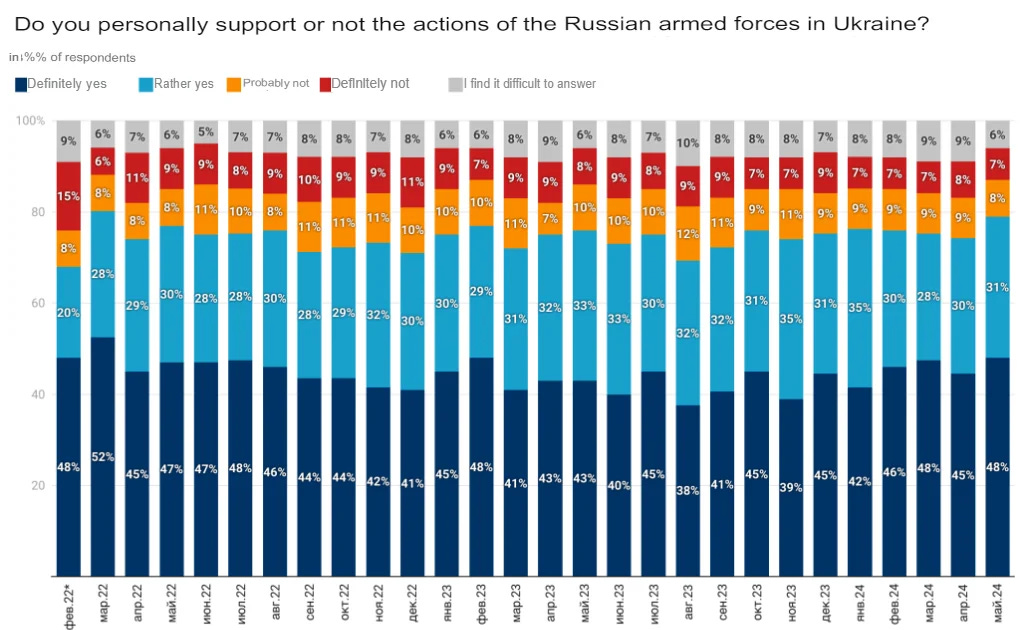

Helmer also has another fascinating new article I recommend checking out, which covers new Russian Levada surveys that show the populace’s support of both Putin and the SMO is actually increasing even in light of Putin’s recent revelations of Russia’s growing casualty list.

According to a nationwide survey by face-to-face interview in Russian homes between May 23 and 29, the Levada Centre in Moscow, an independent polling organisation, reports: “Half of the respondents believe it is necessary to move on to peace negotiations — 43% are in favour of continuing military operations, their share has been growing in recent months. However, the majority is not ready to make concessions regarding Ukraine and this share is growing.

The other huge takeaway:

This also means that Ukrainian missile, artillery, and drone attacks on civilians, refinery and other targets on Russian territory are having no impact on the nationwide commitment to the war and its strategic objectives. On the contrary, threats by NATO leaders to intensify these attacks and extend their range into Russia are increasing public Russian support for lifting Kremlin restrictions on the General Staff’s operational plans for finishing the war at and over the Polish border.

Saving the best and most exciting episode for last:

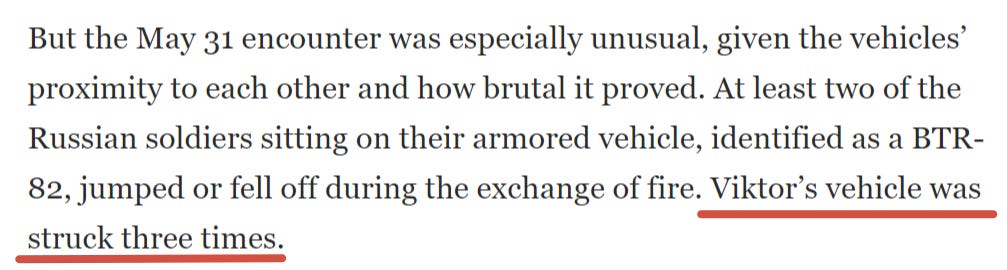

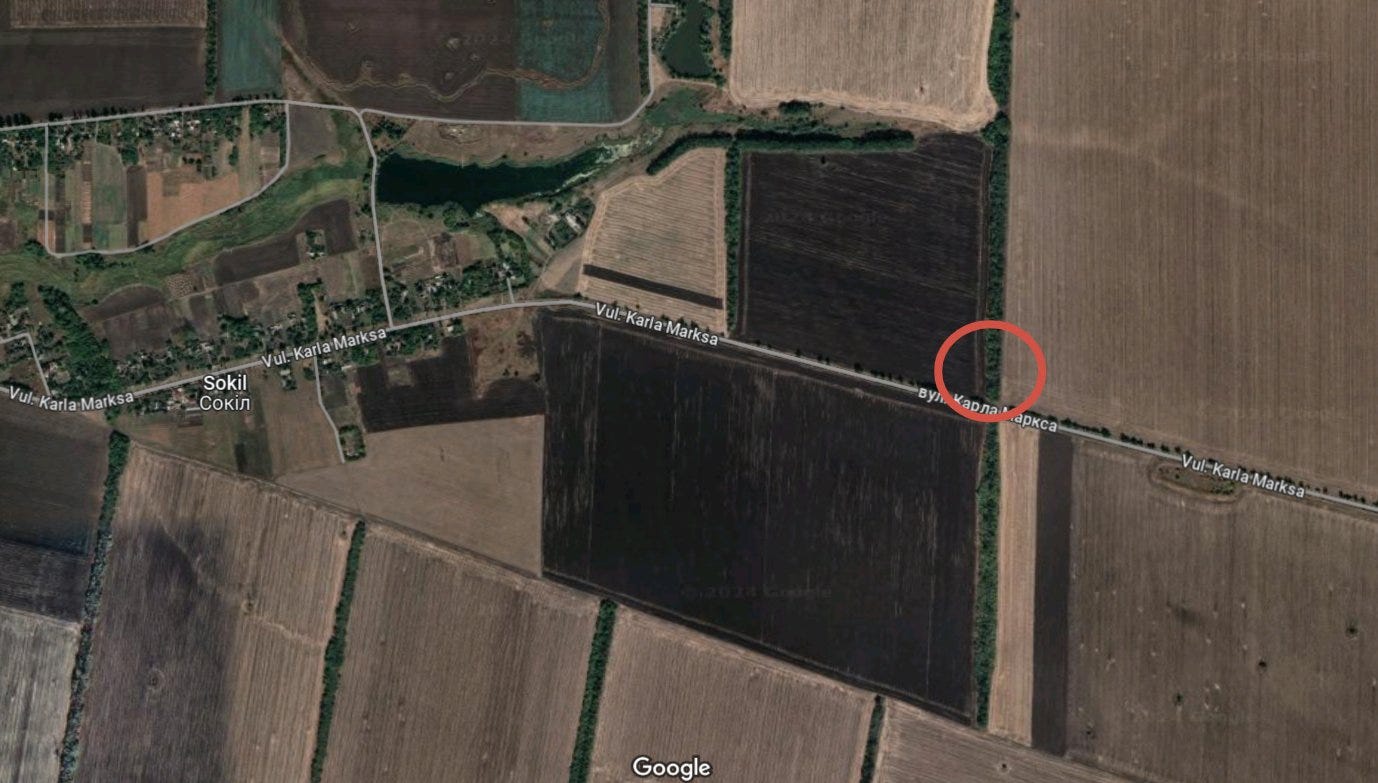

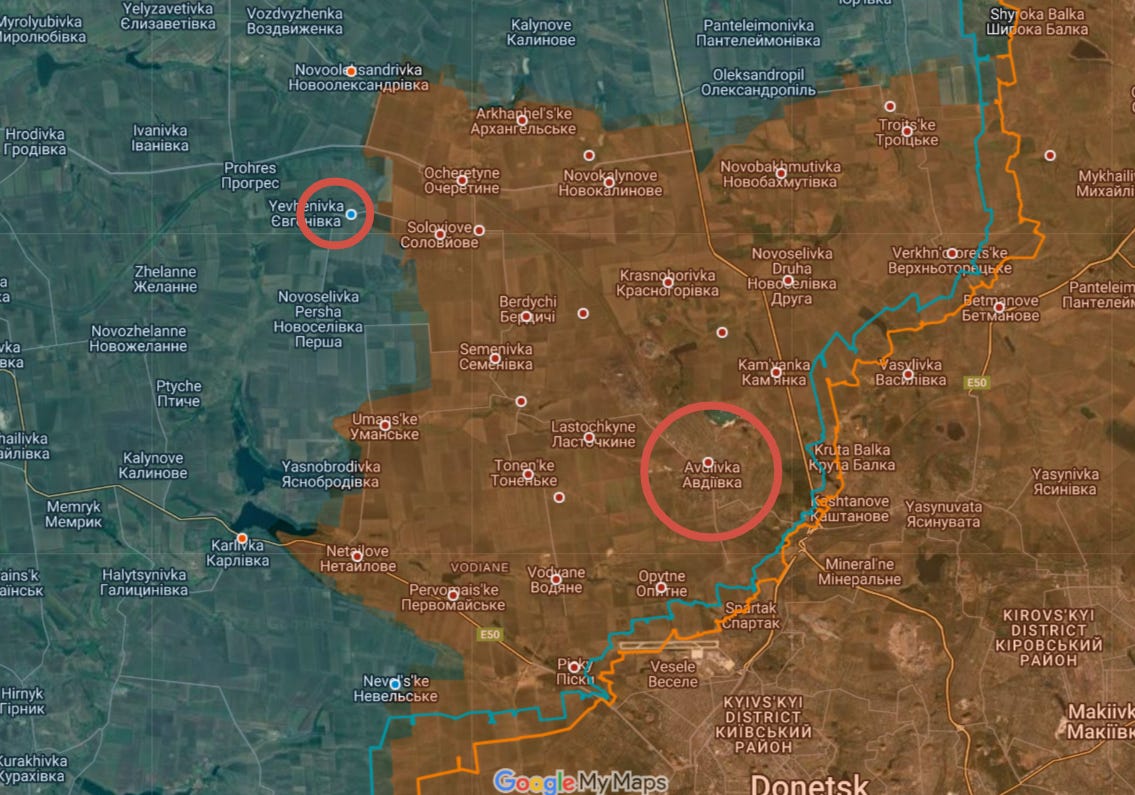

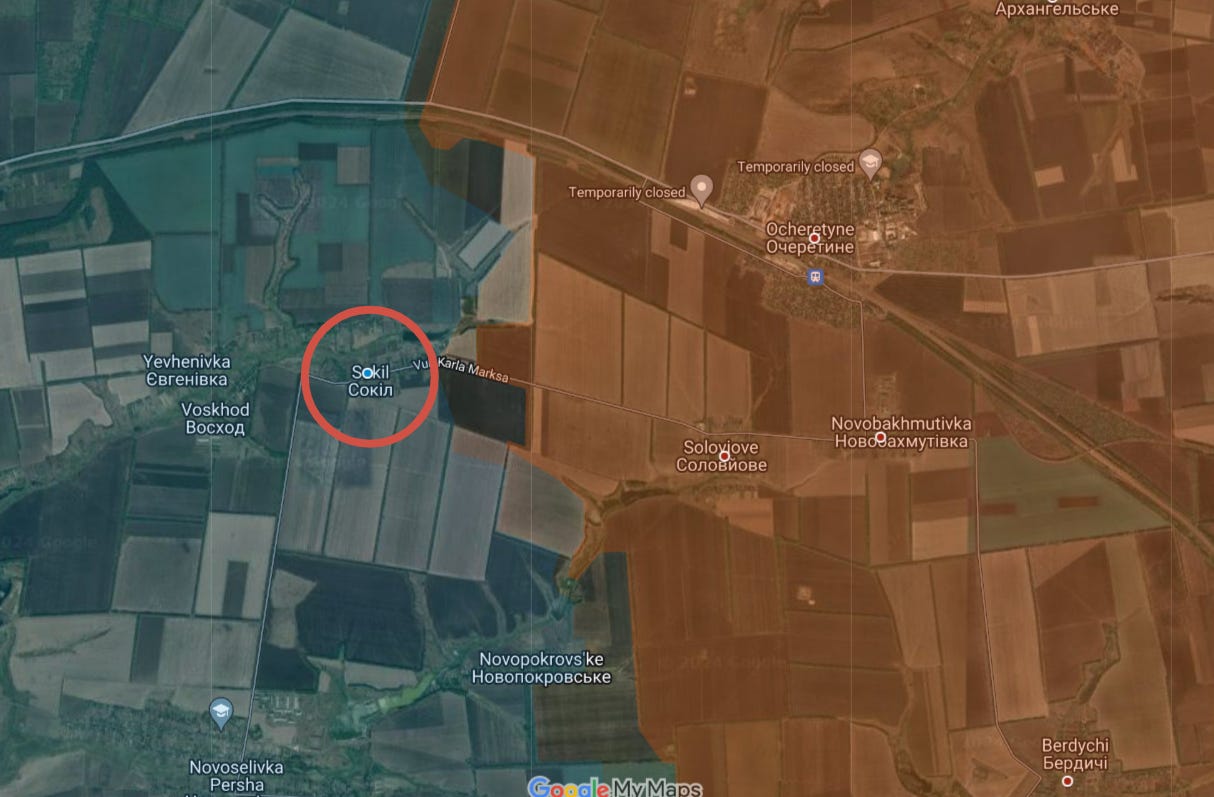

Some may have seen several days ago a battle for the ages took place to the west of Avdeevka, just near Sokol, where Russian forces are actively storming. A Russian BTR-82A carrying dismounts ran headlong into a defending M2A2 ODS-SA Bradley of the Ukrainian 47th Brigade, exchanging fire with it point blank, to what appeared at the time an inconclusive finish. The footage must be seen to be believed:

Geolocation around 48.23277240262418, 37.55843949959025 in Sokol:

The pro-UA crowd prematurely ejaculated rejoiced at the seeming victory of the indefatigable Bradley while I immediately called out the fact that the Bradley appeared disabled and unable to fire back, while the BTR-82A actually completed its mission by transporting its men precisely to the transfer point in Sokol around 48.23202953164239, 37.554706221481055.

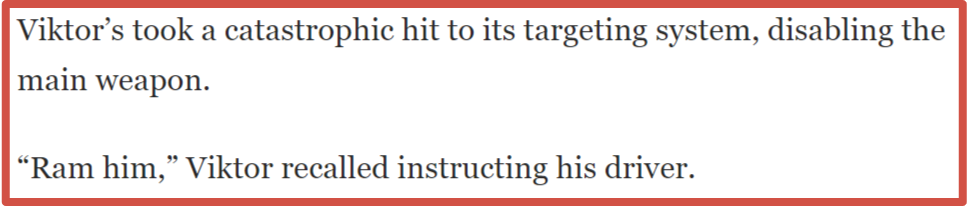

Amazingly, we now have full confirmation from Washington Post, which covered the showdown and spoke to the Bradley commander in question:

Big surprise: it turns out the Bradley was totally disabled by the legacy Soviet iron: the BTR-82A managed to land 3 clean hits of its superior 30mm autocannon onto the Bradley’s fire control system and sights, disabling them and causing the Bradley commander to desperately try and “ram” the Russian vehicle.

The Bradley crew were the worse for wear after hitting a mine in an unspecified incident, which left them with broken legs amongst other injuries despite the Bradley’s claims to superior protection:

But here’s the receipts that Bradley commander Victor’s vehicle was disabled with 3 strikes from the victorious BTR:

What’s remarkable is that the BTR had excuse for lacking situational awareness, as it was jury-rigged with an anti-drone copecage that blocks much of the optics and sensors, leaving only a narrow forward field of view. But the Bradley had no such excuse, and thus the episode proved that the much-vaunted NATO “sensors” and “optics”—said to be so superior to Russian counterparts, and particularly legacy Soviet ones, at that—proved to be worthless as the BTR not only snuck up on the defending Brad, but even managed to out-quickdraw it. The Brad’s 25mm Bushmaster proved futile against the thin-skinned Soviet iron, while the latter’s 30mm 2A72 Shipunov pounded donut-sized holes through the Brad’s sweat-soaked goggles.

The crew appears to have saved face in the WaPo puffpiece, claiming they managed to return home and lost the Bradley in a different battle two days later—but the footage shows them disabled and fleeing after being mowed through by the hellblazing BTR.

By the way, the BTR has no business facing off against a Brad: it’s a light APC that’s nearly half the weight of a Bradley—15t vs. 25t. The Bradley is a full-blown IFV meant for frontline combat.

It just goes to show that real battles aren’t won on steril statistics and WarThunder forum sperg-outs: in reality, any vehicle can defeat any other depending on the circumstances, crew training, local tactical support, etc. That’s why celebrations months ago when a pack of Bradleys allegedly “took out” a T-90M are clueless—the same Bradley commander from that episode later admitted on video that his own Bradley was subsequently destroyed by a different Russian tank.

By the way, take a note of the Sokol location in my above geolocation photo, showing the reservoir in the background. In that exact same area, roughly half a dozen Abrams and Bradleys were destroyed in addition to the one above, showing how viciously—and desperately—the 47th has been trying to defend Sokol from Russian assaults.

The receipts:

Abrams hit at the hedgerow just a few meters east down the road—note the same shaped reservoir you can clearly see, momentarily at the top of the screen:

Location of the above:

Another Bradley destroyed at the same spot:

Location of this one at the yellow X, with the red circle showing the first Bradley which faced the BTR:

And another Abrams destroyed in the field just south of those hedges:

For reference, here’s Sokol (Sokil) in reference to Ochertino and Avdeevka for those who can’t picture where precisely it is:

—

Finally, I’ll leave you with this scathing takedown of Lindsay Graham’s crassly covetous salivation over Ukraine’s treasured trillions by none other than Maria Zakharova:

Your support is invaluable. If you enjoyed the read, I would greatly appreciate if you subscribed to a monthly/yearly pledge to support my work, so that I may continue providing you with detailed, incisive reports like this one.

Alternatively, you can tip here: buymeacoffee.com/Simplicius

Thank you for yet anothe comprehensive analysis.

A couple of notes:

1) When the United States first began, the ONLY income the gov't received was from import duties/tariffs. There was no income tax, sales tax, restaurant tax, hotel tax, property tax, gasoline tax, inheritance tax or anything else. Only goods imported from abroad (not between US states) were taxed. So Trump's proposal isn't totally bananas.

2) I don't think most people realize just how lethal these US sanctions are toward the US dollar. On the entire planet, the USA holds roughly one-third of ALL public debt. And that debt is entirely in US dollars. How does the USA pay its debt obligations? Largely by issuing NEW debt in the form of treasury bonds, etc. Again, all demarcated in US dollars.

If demand for US dollars goes down because countries are switching to using different currencies to settle their trade/debts with each other, then it gets increasingly expensive for the USA to pay off its existing debt, meaning that the servicing cost just grows and grows until it will consume literally everything (i.e. the entire federal budget).

If the USA were financing its debt in the way that China and Russia do (and the majority of countries on earth), by selling tangible goods abroad, then the US dollar might have a chance to survive the same way Ceausescu saved the leu in the 1980s in Romania (via massively ramping up exports and huge cuts domestically). But the US dollar is resting on a foundation of literally nothing except a collective suspension of disbelief - a parlor game in which non-Americans give their blood and sweat to make the US dollar have any value.

It literally is a case of Monopoly money. When you're playing the game, the guy with Park Place is rich. But as soon as you get up from the table, all that wealth is just colored pieces of paper. That's where the US dollar is rapidly heading thanks precisely to sanctions because even countries which had no desire to abandon the dollar are being FORCED TO in order to keep doing business.

It's literal insanity, but the tiny hats are too greedy to stop it.

You know, Russia may be playing a long game but the West isn't pulling punches. They appear quite united, perhaps in servitude to their masters, but united nonetheless. Money keeps pouring in, unlimited, Russian money will be stolen - the $300bn is as good as gone - and the sanctions DO hurt. And because of that unity, they are able to gang up on countries like Kazakhstan, the UAE, whoever, and bully them into sanctions compliance.

They will come up with more levers to pull, and the cost/benefit works just fine, nobody cares that in the end 2mn Ukrainian men will be dead, as long as Russia is a net loser. The Chinese are kingmakers here but too timid, passive, and in a USD dollar prison of their own.

Yes, EU publics are against this thing but elections long stopped mattering, anyone who thinks the EU is a democracy ought to get in line for bidding for the Kerch bridge, I'll send a link lolz. Europe has given up economic development - its been 2+ years of 0 growth - and was happy to write checks to the US instead and tie the noose around their own neck re: stealing Russian sovereign assets. Sure, rule of law and all that but in the end laws are only as useful as the integrity of the societies that enforce them. The Americans meanwhile with their USD hegemony have issued more debt in the last 2 years than the last 20 or something insane like that, Yes, in the long term; like 20 years, this will hurt them and blow up in their faces but not if they are the only ones left standing.

Many say that the Ukr army will collapse or cease to be able to fight. Clearly in Western capitals they think otherwise, and frankly I'm starting to lean in that direction too. Their supply chain is wide open, the entire military-industrial capacity of the west is being provided to them, unlimited money, ISR, you name it. Yes, here we say "they will run out of men" but if thats the strategy, to literally kill everyone; well look at the Israelis in Gaza.

The BRICS alternative for SWIFT/USD needed to be rolled out yesterday.